sales tax rate tucson az 85713

All regional property tax rates for. Tucson Estates AZ Sales Tax Rate.

University Of Arizona Tucson Az Administration Building Etc Campus Postcard Ebay

The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250.

. The sales tax jurisdiction. The 2018 United States Supreme Court decision in South Dakota v. This includes the rates on the state county city and special levels.

This is the total of state county and city sales tax rates. There is no applicable special tax. Whether youre looking to purchase a home putting yours up for sale or exploring rental options get up-to-date information about the 85713 real estate market all in.

The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. Zip code 85713 is located in Tucson Arizona and has a. 2602 W Brandy Crest Dr Tucson AZ 85713 335000 MLS 22215742 Price reduced.

The 2018 United States Supreme Court decision in South Dakota v. 2 beds 1 bath 768 sq. 1820 S Winmor Ave Tucson AZ 85713 213000 MLS 22213901 Fantastic 2 bedroom home in sought after Tucson AZ location.

The City of South Tucson primary property tax rate for Fiscal Year 2017-2018 was adopted by Mayor Council at 02487 per hundred dollar valuation. At higher price seller will offer rate buy. This includes the rates on the state county city and special levels.

Tumacacori AZ Sales Tax Rate. The estimated 2022 sales tax rate for 85743 is. 1960 S Westmont Dr Tucson AZ 85713 310000 MLS 22226741 Amazing starter home is now on the market.

3 beds 2 baths 1106 sq. Tucson is located within Pima County Arizona. The Arizona sales tax rate is currently.

The estimated 2022 sales tax rate for 85713 is. Tubac AZ Sales Tax Rate. Get to know 85713.

The current total local sales tax rate in Tucson AZ is 8700. Tucson Az 85713 tax liens available in AZ. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe.

The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county. Has impacted many state nexus laws and sales tax collection. Tucson AZ Sales Tax Rate.

Remodeled home with brick. The estimated 2022 sales tax rate for zip code 85713 is 870. Tucson AZ 85713.

Find the best deals on the market in Tucson Az 85713 and buy a property up to 50 percent below market value. The minimum combined 2022 sales tax rate for Tucson Arizona is. The December 2020 total local sales tax rate was also 8700.

Has impacted many state nexus laws and sales tax collection. Shop around and act fast on a new. The tucson arizona general sales tax rate is 56depending on the zipcode the sales tax rate of tucson may vary from 56 to 111 every 2021 combined rates mentioned.

The average cumulative sales tax rate in Tucson Arizona is 801. 4 beds 2 baths 1924 sq. 1502 S 9th Ave Tucson AZ 85713 is a single family home that.

The County sales tax.

1831 W Merlin Rd Tucson Az 85713 Mls 22205933 Zillow

Arizona House Committee Approves State Tax Free Gun Purchases Kingman Daily Miner Kingman Az

Tucson Arizona Sales Tax Calculator Us Icalculator

How Much Is The Tax On Marijuana In Arizona

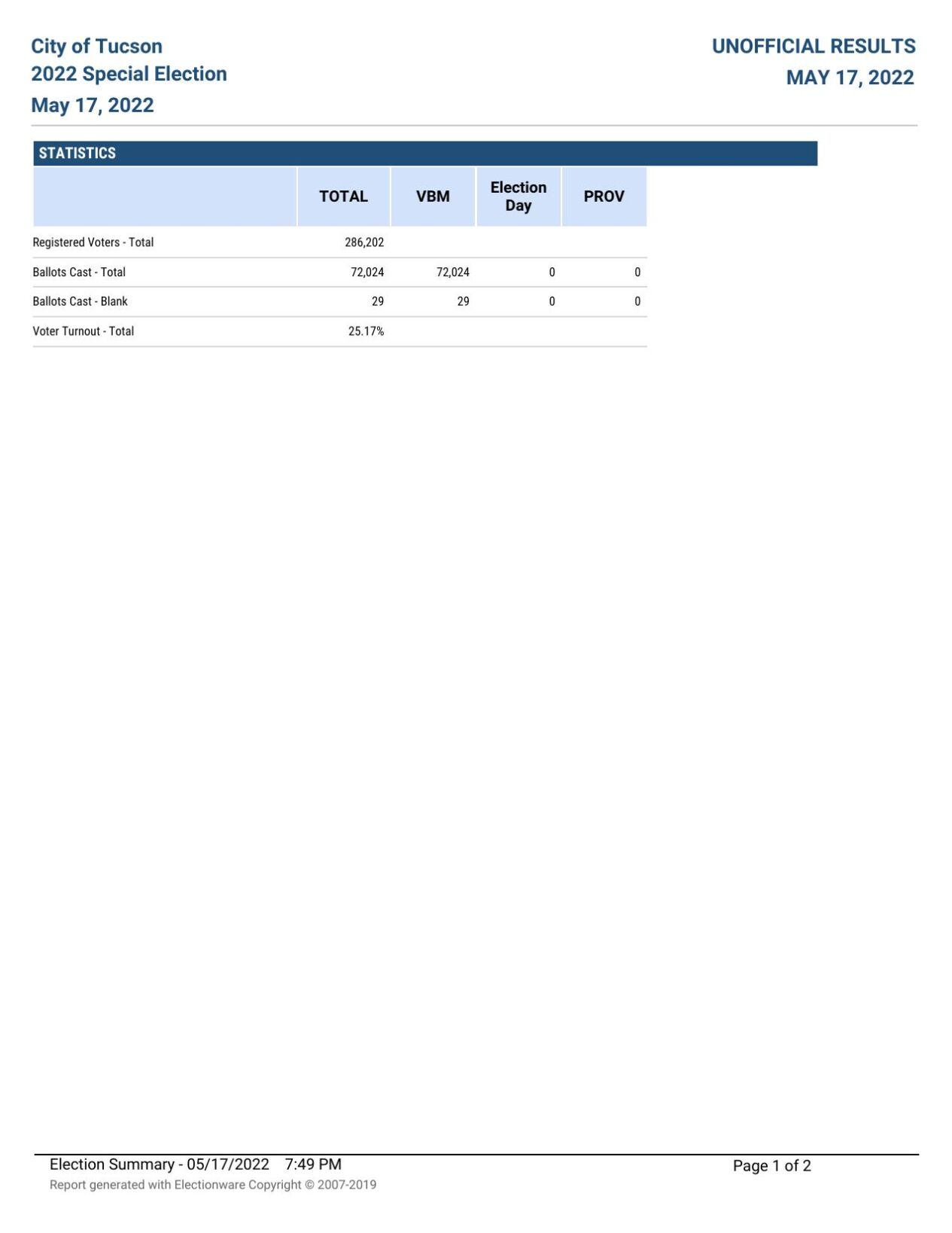

Half Cent Sales Tax Remains In Place After Tucson Voters Approve Prop 411 News Kvoa Com

Setting Up Sales Tax In Qbo Experts In Quickbooks Consulting Quickbooks Training By Accountants

1 Arizona Sales Tax Use Tax Chunyan Pan Tax Manager Financial Services Office Ppt Download

Legislation Would Ban Arizona Cities From Charging Home Rental Taxes 12news Com

Combining Sales Tax Rates Experts In Quickbooks Consulting Quickbooks Training By Accountants

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

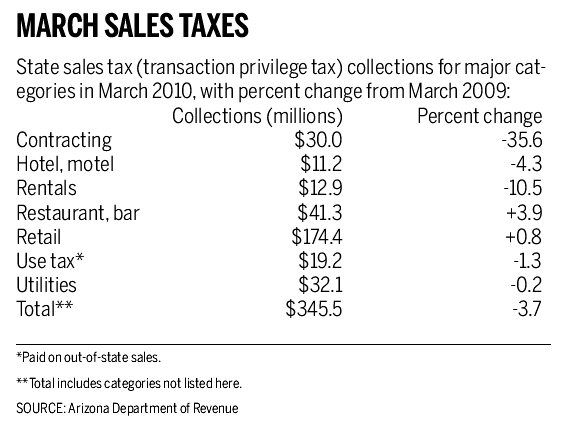

Sales Tax Collections By Arizona Declined

Report Unfair Arizona Tax System Unduly Burdens Poor Residents Cronkite News

Phoenix Area Renters Struggle While Cities Collect Higher Taxes Phoenix New Times

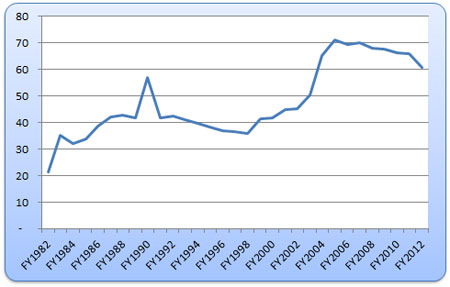

Arizona General Fund Tax Revenues An Historical Perspective Arizona S Economy

Do Arizona Nonprofit Organizations Pay And Or Collect Sales Taxes Asu Lodestar Center For Philanthropy And Nonprofit Innovation

5 Things You Need To Know About Sales Taxes In Quickbooks Online Farkouh Furman Faccio Llp Certified Public Accountants Advisors

New Homes For Sale In Tucson Az Home Builder Lgi Homes

1 How Much Sales Tax Does Trina S Trinkets Owe Each State In 2019 In Your Answer List All States In Which Trina S Operates But If Trina S Does Course Hero